XTCC is the world’s first multi-currency asset class of high-integrity carbon credit investments sourced from verified, renewable energy projects focused on achieving net zero.

Invest in a sustainable future with XTCC.

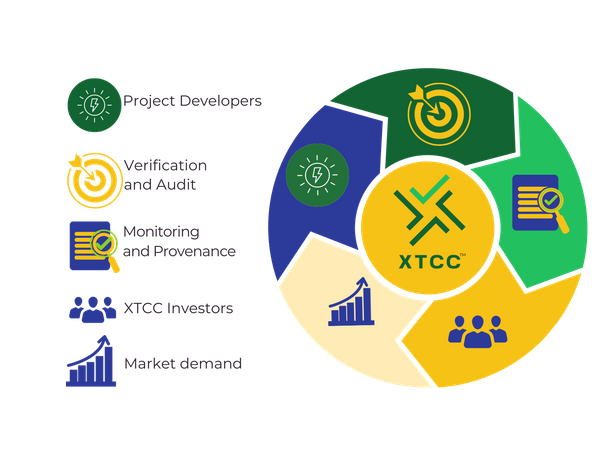

XTCC™ provides investment products that offer a credible, transparent and sustainable avenue for investors to participate in the rapidly expanding high-integrity carbon credits market. This helps to close the gap in the circularity ecosystem, leading to further growth and development of new renewable energy projects. The XTCC ecosystem includes variants for Solar, Blue Carbon, Biomass, Biogas, Hydro, Wind and Biomethanation.

The market for carbon credits may grow 15-50 times by 2030 and XTCC is the only investment product available on a regulated conventional market or digital marketplace to invest in this asset class. XTCC offers the unique capability to be used for pure investment or for offset (retirement) or for hedging the future costs of compliance with increasing carbon offset regulations.

XTCC offers various risk-rated options and products are available in multiple currencies including USD, GBP, AED, EUR, BTC and ETH.

“Oil was the commodity of industrialisation.

High-integrity carbon credits are the new asset class

for the 21st Century and a net zero world.“

— Dr Scott Levy, Founder, XTCC

XTCC offers a range of investment products for investing in high-integrity carbon credits. These credits are authentic, transparent and can be traded easily across platforms and projects. The market for high-integrity carbon credits requires both liquidity and credibility, which are essential for achieving net zero targets.

XTCC offers a variety of products that are suitable for environmentally conscious investors who want to promote the benefits of circularity and support the development of renewable energy projects. XTCC also encourages renewable energy developers to reinvest in further projects, thereby contributing to the global efforts towards achieving net zero emissions.

According to reputable sources such as McKinsey, Bain, BCG, Barclays, Morgan Stanley, Shell, Nomura, BloombergNEF, the World Bank and the Norwegian Sovereign Wealth Fund, high-integrity carbon markets are expected to experience significant growth in the coming years. The market is predicted to increase by more than 15 times its current size by 2030.

XTCC employs standard institutional documentation, making high-integrity carbon credits easily investable. It is available in multiple currencies, including USD, GBP, AED, EUR, BTC and ETH.

By establishing connections with prominent clearinghouses, XTCC can tap into trillions of dollars of investor liquidity, enabling the creation of an efficient market for high-integrity carbon credits.

XTCC only includes high-integrity carbon credits, which recognise the importance of additionality and co-benefits.

XTCC partners with ZERO13 and Bondstream to give confidence in the carbon credits’ accountability, provenance and transparency for investors.

XTCC can be used for short-term investments or retirement for offset purposes. XTCC is THE commodity investment for net zero.

Leveraging the Bondstream cap table management system, XTCC connects mainstream capital markets with the digital currency realm, resulting in the first-ever digital and conventional clearable securities with cross-market liquidity.

Funds from XTCC investments provide liquidity to the high-integrity carbon credit market. This liquidity closes the gap and should incentivise the development of more renewable energy projects, aligning with global net zero objectives.

Circularity is central to XTCC; the final piece of the puzzle with the allocation of proceeds that encourages further renewable energy project development and growth.

XTCC high-integrity carbon credits are sourced from renewable energy projects that measure and report impact against identified United Nations Sustainable Development Goals (SDGs); information which will be reported regularly to the market.

A commitment to creating an efficient and transparent market for high-integrity carbon credits requires that XTCC is aligned with the United Nations Framework Convention on Climate Change (UNFCCC) and highlights the importance of additionality and co-benefits.

XTCC offers a ecosystem of investment products which is a complete asset class solution for both investment and offset (retirement) purposes by sourcing high-integrity carbon credits from projects including solar, wind, hydropower, biogas, biomass, biomethanation and blue carbon.

XTCC offers various risk-rated investment options and products are available in multiple currencies including USD, GBP, AED, EUR, BTC and ETH.

Take a look into our detailed product insights in our Investor Deal Room. Tailored for investors, this portal offers a comprehensive look at XTCC offerings and the potential for growth. Whether seeking to expand portfolio or explore new ventures, XTCC Deal Room provides all the essential information needed to make informed decisions.

The information provided in this website has been prepared by Sustainable Capital PLC (the "Company") for professional clients and eligible counter-parties. The information, material and applications presented in this website are provided to you for information purposes only and nothing contained on this website is, or should be considered as, an offer or a solicitation to sell or an offer or solicitation to purchase any of the products described on this website. The information provided on this website is not, and may not be construed as constituting, investment advice or any form of recommendation as regards either individual products or strategies for investors. Before undertaking any transaction, you must seek professional advice. All investments are governed by their relevant terms and conditions and prospectus and these should be read carefully. This is not an unusual provision but one which most people ignore. We strongly suggest that you carefully consider your position with regards to tax and other matters before undertaking any financial activities. Your use of this site is governed by this disclaimer. The XTCC logo and related marks are trademarks and the intellectual property of Ethical Ventures OÜ.

Copyright Ethical Ventures OÜ, 2024

All Rights Reserved